stamp duty malaysia lhdn

In summary the stamp duty is tabulated in the table below. If buying a new home is on your mind this year it is critical to understand the property stamp duty and how you can get a stamp duty exemption especially for a first-time house buyer Stamp.

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

. 1What is Stamp Duty. Duration of Tenancy Agreement. However it is not fully Online at this point of time due to payment still requires to be done at.

Those buying homes at. Responsibility of Company Secretary Registrar. Based on the table below this means that for.

Dimaklumkan aktiviti penyelenggaraan STAMPS akan dijalankan pada. Why do we need to stamp the from. For Example If the loan amount is.

Stamping Instruments executed in Malaysia which are chargeable with duty must be stamped within 30. Stamp duty on foreign currency loan agreements is generally capped at RM2000. We are also a registered agent to submit the electronic assessment to the LHDN and apply for payment of stamp duty for certificates to be issued accordingly.

The tenancy agreement must be stamped by lhdn and put into effect by or after january 2018. Above table listed are for the main copy of tenancy agreement if you. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

Stamp duty payable RM150000 x RM300 RM1000 RM45000 4 APPENDIX 1A XYZ SDN. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act.

So for a property priced at RM500000 you would typically apply for a 90 loan. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

The Inland Revenue Board LHDN said in a statement that Malaysians and permanent residents with income tax numbers can register an account or user ID on the portal. The stamp duty payable is therefore calculated based on par value ie. Relief From Stamp Duty.

STAMP DUTY EXEMPTION 2021 UP TO RM500000 PROPERTY VALUE. I got the following table from the LHDN Office. Its quite simple to calculate Loan Agreement Stamp Duty.

Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. The stamp duty for a tenancy agreement in Malaysia is calculated. With the Technology Advanced and Internet of Things LHDN stamping also move to online.

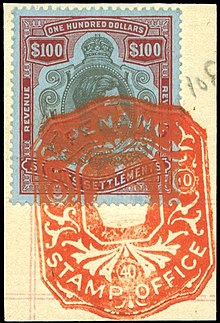

The rate of duty varies according to the. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. Stamp Assessment and Payment System STAMP merupakan sistem taksiran dan bayaran setem.

Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement. Sistem akan tidak dapat diakses pada waktu tersebut. Stamp duty payable rm925000 x rm300 rm1000 rm277500 appendix 2a abc sdn.

Following the above the Stamp Duty Remission Order 2021 PU. 18102021 1000 Malam - 19102021 100 Pagi. With the new announcement Stamp Duty 2021 exemption you will get the maximum RM9000 and.

RM5000 or 10 of the deficient duty whichever is the greater if stamped after 3 months but not later than 6 months after the time for stamping. A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December. There are no scale fees its a flat rate of 050 from the Total Loan Amount.

Amendments To The Stamps Act 1949. Malaysia September 12 2022. Hasil Stamp duty Exemption 2022 MOT Malaysia.

RM10000 or 20 of the deficient duty. Tenancy Agreement Stamp Duty Malaysia. A tenancy agreement stamp duty which is a form of taxes.

Will not have to pay stamp duty on purchases made through the Keluarga Malaysia home ownership programme from June until December 2023.

Contactless Rental Stamp Duty Tenancy Agreement Runner Service

Stamp Duty In Malaysia What You Must Know For Tax And Exemptions When Buying Commercial And Industrial Properties Industrial Malaysia

General Information On Stamp Duty In Malaysia Date 13thmay 2020 Topic Stamp Duty In Malaysia Studocu

Stamp Duty Malaysia 2019 New Updates Youtube

Revenue Stamps Of Malaysia Wikipedia

Digital Franking Latest Version For Android Download Apk

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

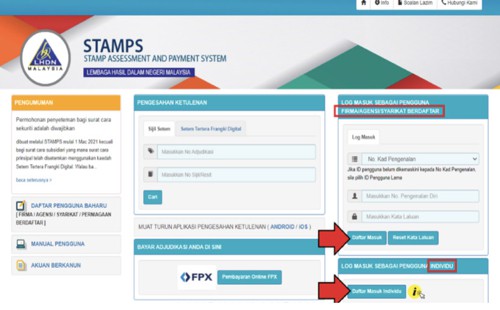

Guidelines On The Stamping Of Share Transfer Instruments

Apply And Pay Online For Hasil S Individual Document Stamping Via Stamps From April 27 Dayakdaily

Stamp Duty Malaysia Lhdn Archives Malaysia Housing Loan

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

Stamp Duty Counter At Irb Opens From 8 Am To 1 Pm

How To Organize Financial Records

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Contactless Rental Stamp Duty Tenancy Agreement Runner Service

Stamping Of Tenancy Agreement Semionline Property Malaysia

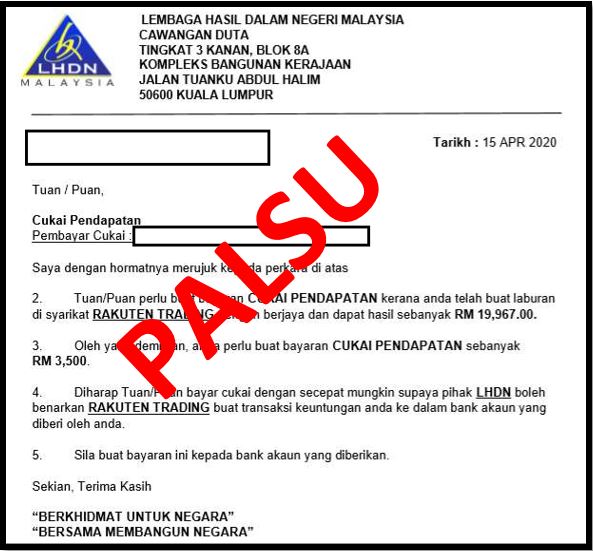

Beware Of Tax Scams Lembaga Hasil Dalam Negeri Malaysia

Irb Application Stamping Fees For Individual Documents Can Be Made Online Via Stamp Assessment And Payment System From April 27 Malay Mail

Comments

Post a Comment